Industry Case Studies

SINCE 2003...

Servicing and supporting clients in and around the Boston, Cambridge Greater Region.

SAME TEAM FOR 15 YEARS +

No huge call centers, No junior-junior reps. A small and agile team with a depth of knowledge in technology. Its what you want…

Industry Case Studies

Industry Case Studies > IDC MARKETSPOTLIGHT

How Advanced Video Collaboration Can Enhance Communications Effectiveness and Productivity for SMEs

Enterprises of all sizes, but especially small and midsize enterprises (SMEs), face a variety of communications challenges, both in supporting internal collaboration and in working effectively with partners, suppliers, and customers. While physical meetings remain the optimal way of engaging others for information sharing, persuasion, and relationship building, technology is playing an increasingly important role. Phone conversations, email, texting, and instant messaging all support two-way communications, sometimes in real time and sometimes with “call and response” time lags.

But none of these options provide the rich detail of a personal conversation or group discussion. Video collaboration, most often in the form of videoconferencing combined with content sharing (e.g., sharing a presentation or document on a PC screen or even a smartphone or tablet), can provide the additional visual dimension to enhance communications effectiveness. Historically, however, business-grade systems have been complicated and expensive for SMEs.

Some larger firms use video collaboration between major facilities via dedicated conference room video collaboration solutions. At the other end of the sophistication scale are the non-business-grade options that some SMEs have been using on personal devices. The consumer-based options have drawbacks too, however, in terms of both video quality and the ability to extend beyond individuals who want to share a video experience while using a PC, tablet, or traditional room-based videoconferencing system. Today, however, there are alternative solutions that combine the sophistication of traditional room-based systems with the flexibliity, ease of use, and affordability of more consumer-based offerings. This Market Spotlight examines the latest video collaboration options for smaller businesses (firms with <100 employees) as well as midsize firms (firms with 100–999 employees, or even somewhat larger) and the potential benefits the technology can bring to these businesses.

Competitive Pressure: Improving Productivity and the Role of Video Collaboration

Both small and midsize firms share two fundamental business priorities: drive revenue and improve productivity. For midsize firms in particular, the goal of enhancing worker effectiveness is cited almost as much as the goal of increasing revenue as a key business objective. Of course, both goals serve the greater goal of increasing profitability, but the efficiency of the smallest firms is hard to maintain as firms grow (more employees, more branch offices) and processes become formalized. Costs go up even as communications efficiency becomes more challenging.

At the same time, this means that the potential bottom-line benefits of communications improvements become greater as well. Extending personal reach through video collaboration can be a “force multiplier” that not only improves efficiency but, because of the video dimension, adds significantly more insight and detail for all participants. Nonverbal cues can reveal the potential agreement with or resistance to a message that simple verbal responses may not. This allows potential concerns to be addressed on the spot and can also help streamline a discussion when agreement is clear. There is a natural relationship between broad business goals and specific technology investment areas. IDC found that SME technology investment typically goes to support existing infrastructure (upgrade PCs and networks, improve storage and security) or moves to new innovative areas (cloud and mobility to extend resources and empower remote workers). Sharpening current technology capabilities and bringing on new capabilities would be other ways of looking at spending priorities, and firms often shift between the two from year to year or even quarter to quarter. Video collaboration is actually associated with both investment objectives — it enhances existing communications resources but also extends into new functional areas of internal communications and external partner and customer connections (so it can be related to the high-impact areas of mobility and social media).

Video Collaboration Proof Points: SMB Use of Technology and Association with Success

While advanced video collaboration is still modest in small and midsize companies, there are associations between the use of advanced video collaboration resources and business success. Roughly 6% of small businesses and 30% of midsize firms are currently using video collaboration resources beyond personal Webcams or shared audio while viewing the same slides or other material. Intentions are at roughly the same level, which sets the stage for significant growth in usage: the number of SMB firms using video collaboration could potentially double in the next 12 months.

Part of the appeal of video collaboration is its potential contribution to business efficiency in an increasingly competitive environment. IDC found a strong association between SMBs’ use of advanced video collaboration and the attitudes closely associated with business success. SMBs that had invested in video collaboration were more likely to see annual revenue growth of 10% or more than companies in general. They were also more likely expanding their IT investment to support their business goals.

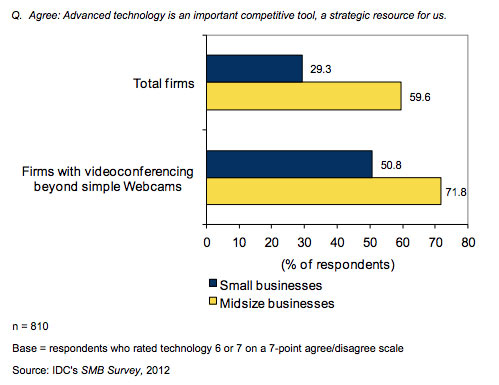

Also noteworthy was agreement among video collaboration users that technology is an important competitive resource that helps distinguish them from others in increasingly challenging times (see Figure 1). While some firms invest in technology as a way to simply do things faster or less expensively, others invest to do things differently and in ways that add value or transform the business.

Video communications deployment has the potential benefit of competitive differentiation near term, but IDC believes the reverse could be the case over time. There will be increasing risk in not keeping up as customer and partner comfort and expectations with regard to video collaboration could be a preferred way for consumers to engage with firms, much like company Web sites are increasingly preferred as a way to gather information or get questions answered.

The Business Value of Video Collaboration

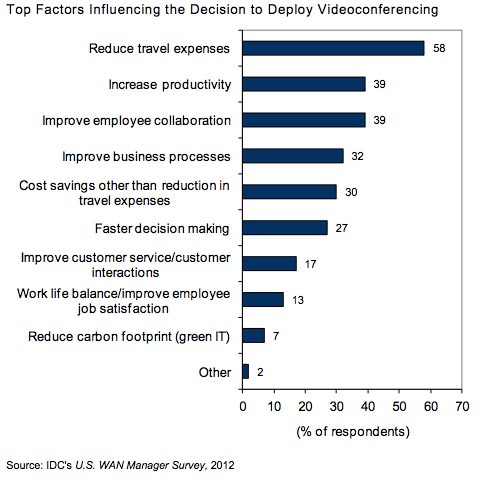

In IDC’s 2012 U.S. WAN Manager Survey, in which the sample by company size is fairly evenly distributed across six segments from 5–49 employees up to 5,000+ employees, IDC asked the following question of those respondents who indicated they use videoconferencing: “What are the top factors that influenced your organization’s decision to deploy videoconferencing?”

The top responses (see Figure 2) elicited a range of reactions from “totally anticipated” to “rather progressive.” The “totally anticipated” responses included reduce travel expenses (58%), increase productivity (39%), and improve employee collaboration (39%). What IDC found “rather progressive,” though, were the fairly significant response rates for improving business processes (32%) and faster decision making (27%).

For IDC, these survey results help confirm the growing awareness around businesses deploying and using video collaboration applications in new and creative ways such as:

- Specific vertical-market applications of video (e.g., in retail, manufacturing, education, or healthcare, to name a few that are popular)

- In a UC scenario, embedded links that can provision a list of document contributors or subject matter experts (as well as their present availability) and the ability to summon the required expertise on demand via a choice of multiple methods of collaboration, including video

These new and creative ways to use video collaboration applications are actually transforming how some companies work today as well as creating advantages for them over their competition. A business-to-consumer (B2C) example of a competitive advantage via video is the car rental business, which is typically plagued by long wait times for renters trying to get to the counter to process their rental agreements. Some car rental agencies now offer video kiosks that provide customers with live, face-to-face, interactive access to a video agent for processing the rental agreement.

The video kiosks/agents can perform all the services of a live agent such as scanning the required documents (i.e., driver license and rental confirmation number), completing the transaction, printing receipts, giving directions, and answering questions. The use of video kiosks for car rental agencies can significantly decrease (by as much as 50% or more) the amount of time a customer has to wait in line to get a car.

A good business-to-business (B2B) example of competitive advantage through video collaboration is being driven by the advent of browser-based client support in video collaboration solutions. Utilizing a Web browser as a real-time video client enables businesses to extend video collaboration, typically via a link in an email or text invite, to users external to the business (clients, partners, suppliers, etc.). With a click of the link, a one-time download of a software plug-in is usually all that’s required to launch an external user into the business video call from a room, desktop, laptop, smartphone, or tablet. Web browsers can enable real-time voice and video collaboration for users who otherwise would not be privy to internal business video collaborations. For example, a sales manager with a geographically distributed team canhold weekly sales meetings on video to better establish relationships and gauge reactions during forecasting. The same team can likewise hold more personal meetings with prospects and customers without having to travel.

The takeaway from these examples should be fairly obvious to businesses of all sizes: deploying communications technology (in this case, video) in new ways can truly transform how you conduct your business and compete in your market(s). Ask yourself a basic question: How much would being able to visually collaborate with your external partners, suppliers, and customers in a reliable, professional way strengthen your business relationship with them?

Videoconferencing Cost Factors

As previously mentioned though, things like reducing costs, driving revenue, and increasing productivity to get more out of your workers tend to be particularly top of mind for SMEs. No doubt the most quantifiable benefit for companies that use a videoconferencing solution is a reduction — or elimination — of the costs associated with traveling to an onsite meeting, including airfare, hotel, food, car rental or local transportation, and other miscellaneous expenses. IDC estimates that domestic business trips typically average about three days in length, with an average cost of $2,000 per trip (with international trips averaging longer). If an executive takes two trips per month, that’s just under $50,000 annually. If there are, for example, five employees taking similar business trips, the travel expenses can potentially reach up to $250,000 or more annually.

Traditional Video

For comparative purposes, traditional basic cost factors should be considered when procuring an on premises video collaboration solution. For example, there are an increasing number of video solutions to choose from today, ranging in price from a few thousand dollars per endpoint ($5,000 and below) to a couple hundred thousand dollars (or higher) for high-end telepresence solutions. There are also the primary video infrastructure components needed to support the endpoints — such as hardware MCUs — which can run $2,000–4,000 per port (multiplied by the number of video user ports required).

Then there are software MCUs, which are also growing in popularity and can be implemented for significantly less than hardware-based MCUs today (as low as one-fourth the cost). Organizations should also take into account sufficient LAN bandwidth capability, which is required in the network to support the video endpoints. IDC estimates that for WANs, the average cost of managed WAN bandwidth is about $100/Mbps per month, depending on the provider, but this cost can fluctuate depending on the type of circuit used.

There are also business video service offerings today that are delivered via cloud services with low or no upfront capital expense and attractive monthly subscription rates per user. As mentioned previously, the use of browsers as video endpoints is also starting to proliferate.

If a managed video service option is required from the vendor or partner (versus the business managing the video in-house), that can average about $2,000–3,000 or more per month, depending on the specific requirements and configuration. You should also expect “other” costs, such as installation, video overhead, and smaller video infrastructure component costs (gateways, firewalls, etc.).

New Emerging Solutions

Beyond the traditional videoconferencing technologies, there are new, emerging ways in which highquality video collaboration can be deployed in the enterprise — solutions that are well suited to the SME in terms of simplicity of installation, management and use, and features and costs. One example provides desktop, mobile, and room-based video collaboration — including HD video, data sharing, and chat — in a simplified package that is offered at a fraction of what the typical traditional room-based video system costs. Further, the solution offers integration with a wide range of devices, from smartphones and tablets to Mac and PC computers, as well as standards-based traditional videoconferencing room systems. The fact is, today, SMEs have greater choices for video that suit their needs and budget.

The bottom-line analysis that all companies should perform when considering a video collaboration solution is whether the cost-savings benefits of the new video solution(s) will outweigh the costs associated with implementing new endpoints and infrastructure, including bandwidth, overhead, and services costs. Obviously, the higher the rate of return on the investment (%) and the shorter the payback period (e.g., 10 months versus 2 years), the better.

Business Benefits

Creating a more robust collaborative environment positively impacts business operations with revenue implications as well. Because it is difficult for organizations to quantify the impact on productivity from videoconferencing solutions, we do not attempt to quantify that benefit here. However, IDC feels that video collaboration positively impacts businesses in two primary ways:

- Enhanced collaboration practices, including video collaboration, can potentially save businesses hundreds of thousands of dollars.

- Increased productivity from better operations results in faster decision making, decreased time to market, better overall quality of work, less customer churn, and better products and delivery.

Considerations

Independent of the video collaboration approach that seems best suited to meet a company’s needs, there are a number of critical challenges related to deployment and operations that will have to be met. As with many technology acquisition decisions, preparation and implementation are essential to ensure that all potential benefits are received — those that are anticipated and those that are unexpected (which often are just as important). Two best practices to consider are:

- Train and deploy with care, building a community of committed users. While some potential users may already be comfortable using video collaboration, it is best to assume that this is not the case. Identify departments and potential user groups with the greatest potential for benefit, and work with them to establish comfort and build an effective group of evangelists in the company that can educate users about as well as demonstrate strong business results from videoconference use.

- Make certain technology works effectively with external constituents. Ease of deployment and use will be essential for success, especially among non-employees. Make sure that video quality will be of sufficient quality across different operating conditions you are likely to encounter. Bandwidth and other infrastructure elements will make the issue of interoperability especially important depending on your goals. In addition, ease of engagement (e.g., through “click to call” and freely downloadable clients) will allow a company to engage effectively and efficiently with its extended community.

Conclusion

Small and midsize companies recognize the need to be more efficient and to support new approaches to streamline internal processes and enhance relations with external partners, suppliers, and customers. In an increasingly competitive environment, investing in new technology solutions rather than adding more staff has been a key to productivity and profitability gains. In a similar way, video collaboration offers an important way for firms with multiple locations (the majority of firms with 20+ employees) to improve operating practices.

Video collaboration also allows workers to engage in effective videoconferencing in mobile, desktop, and conference room environments. This allows collaboration when and how collaborators prefer, providing the flexibility that will encourage use and build skills. As resources extend beyond internal company participants to external constituencies, so will the benefits of improved communications, including higher levels of loyalty, closer personal relationships, and better understanding of needs — all of which will enhance companies’ financial performance.

ABOUT THIS PUBLICATION

This publication was produced by IDC Go-to-Market Services. The opinion, analysis, and research results presented herein are drawn from more detailed research and analysis independently conducted and published by IDC, unless specific vendor sponsorship is noted. IDC Go-to-Market Services makes IDC content available in a wide range of formats for distribution by various companies. A license to distribute IDC content does not imply endorsement of or opinion about the licensee.

COPYRIGHT AND RESTRICTIONS

Any IDC information or reference to IDC that is to be used in advertising, press releases, or promotional materials requires prior written approval from IDC. For permission requests contact the GMS information line at 508-988-7610 or gms@idc.com.

Translation and/or localization of this document requires an additional license from IDC.

Adapted from Worldwide Enterprise Videoconferencing and Telepresence 2012–2016 Forecast by Rich Costello, IDC #233538 Sponsored by Avaya

Other Case Studies

- Cloud-Based Telecommunications Solution

- iPBX Hosted Communications System

- Video Collaboration Effectiveness for Businesses

- Mitel Sky Product Integration with Salesforce.com Integration

- Improving Productivity and Analytics with ShoreTel Sky

- 4G Continuity by TPX Communications

- Mira Connect Delivers Happiness to Zoom Users

- 2Voice Enabled Office365 by Calltower

- RingCentral and Box: A Partnership Focused on Productivity

- Commercial Building Automation with Savant Systems